Previously, in Part One, we unearthed the beginnings of individual property rights, which are at the core of real estate escrow functions. Now, as we take a look at the 19th and 20th centuries, things are going to shift. Industrialization and the cultural changes that came with it didn’t just update escrow; they turned it into a tangled system of controls and obligations. We need to talk about how these centuries reshaped escrow into the complicated mechanism we contend with now, and why it's so dang hard to unwind.

The practice of using a trusted third party to hold funds and documents (and deeds, in the case of real estate) until the obligations of a transaction are met has been an integral part of most transactions for a while. In the 19th century, real estate transactions were predominantly paper-based, with minimal exchange of large sums of cash. Local banks kept limited cash on hand due to robbery concerns, so deals often involved the seller holding the buyer's mortgage and acting as the bank themselves. Closings were relatively simple affairs where the buyer and seller would meet with a scrivener or lawyer, sign some paperwork, and then make small payments over time.

The landscape began to shift in the late 1800s and early 1900s as banks started providing mortgage loans for residential real estate purchases. These loans typically were only for around 50% of a properties' value and had to be paid off in five years. The financial collapse of the Great Depression led to widespread foreclosures as borrowers were unable to refinance these loans, and the FDIC wasn't yet there to save the day.

The Gilded Age

Interestingly, the deflationary period in the late 1800s and the introduction of the Federal Reserve and fractional reserve banking system played a significant role in shaping the real estate market during this time. This period of deflation, characterized by falling prices and a contraction in the money supply, made it difficult for borrowers to repay their loans, as the value of their assets decreased while their debt obligations remained the same. This, coupled with the lack of a central banking system and the absence of deposit insurance, contributed to the instability of the banking system and the vulnerability of borrowers.

The introduction of the Federal Reserve in 1913 and the adoption of the fractional reserve banking system aimed to address these issues by providing a more stable and flexible financial system. The Federal Reserve acted as a lender of last resort, providing liquidity to banks during times of crisis, while the fractional reserve system allowed banks to lend out a portion of their deposits, increasing the money supply and stimulating economic growth.

However, this new "stable" and "flexible" financial system didn't operate as intended. The increased availability of credit and the loosening of lending standards contributed to a massive speculative bubble in the real estate market during the 1920s, which ultimately burst, further contributing to the Great Depression with almost half of borrowers in default by 1933.

Government Intervention via New Deal

In the aftermath of the Great Depression, the Federal Housing Administration developed the fully amortized fixed-rate mortgage, which paved the way for the modern closing process. Banks began using attorneys, title companies, and escrow companies to handle closings and disburse funds, although this practice was not yet the norm.

So why is all this "the norm" today? Well, the real estate closing process of the mid-20th century often involved the buyer signing loan documents, the lender depositing funds into the buyer's account, and the buyer then writing multiple checks for the seller's proceeds, mortgage payoff, commissions, taxes, and fees. This method was inefficient and required significant trust in the buyer's proper use of the loan funds. Banks were sweating bullets.

The turning point came when title companies began taking responsibility for paying off the seller's prior mortgage. This development encouraged lenders to force home buyers to use title companies to disburse loan funds, and it ensured a clean title insurance policy and a first lien position for the lender.

Title insurance had its emergence in the late 1800's as well, but didn't become the de facto way to protect buyers and lenders from potential title defects until the American Land and Title Association (ALTA, formed in 1907) standardized title insurance in 1929. Title companies thereafter began also offering escrow services since providing a neutral third party to manage the disbursement of funds and documents seemed to have a lot of synergy (and additional profit).

Escrow and title insurance get married and become an institution

Then came Fannie Mae, Freddie Mac and the Fair Housing laws, along with the passage of the Real Estate Settlement Procedures Act (RESPA) in 1974. RESPA introduced regulatory functions under the Department of Housing and Urban Development, including the creation of the standardized HUD-1 Settlement Statement form. The preparation of the HUD-1 became the responsibility of the title agent, closing lawyer, or escrow company. Meaning, if a bank lender was being utilized in a home purchase, a HUD-1 was required, and only a handful of qualified entities could provide it.

In 1974, at the time of RESPA's enactment, less than half of all residential mortgages involved the use of an escrow agent. However, by 2019, it's estimated that 98% of residential transactions are completed with the involvement of a neutral third party handling the escrow process.

Isn't all this a good thing? Title insurance sounds valuable.

The majority of Americans will never complain about the way this all works, unless the wheels seriously fall off the bus. Insurance for a home buyer and their lender against claims of ownership from the past can be an ace in the hole for some situations. Here's a few real examples in defense of title insurance being fused with the escrow process.

Consider the tale of a couple in California who, while trying to close on their dream home, were asked to provide not just their current financial statements but also documents tracing back a decade. As if that wasn't enough, the title company required a notarized letter from a previous landlord – who had since moved to another continent – to verify a rental agreement from eight years prior. The couple spent weeks tracking down the landlord, who was finally found living off the grid in a remote village, only to discover he no longer had the documents because of a termite infestation.

Then there's the story of a buyer in New York City who found themselves entangled in a web of conflicting title claims. During the title search, it was discovered that the property had once been owned by a long-defunct 19th-century investment firm, which had issued shares to descendants who had scattered worldwide. Each shareholder's descendant had to be located and convinced to sign off on the sale. One descendant, a hermit living in the Appalachian Mountains, refused to come down to sign the paperwork unless personally visited and brought a jar of rare, local honey.

But the data tells us that stories like these are outliers nowadays. So why are "escrow" and "title insurance" synonymous in a real estate closing?

It's a profit center, guaranteed by the lenders.

In Texas, title insurance providers have a stellar loss ratio; meaning the amount of money they have to pay out due to claims is nearing zero. The Texas Observer crunched the numbers a few years ago:

"In 2017, the latest year for which data is available, title companies sold $1.8 billion worth of policies, according to the Texas Department of Insurance (TDI). Of that, title companies retained $1.5 billion and paid $335 million over to their underwriters, the companies that actually compensate policyholders in the event of a claim. But according to TDI data, only about $24 million was needed to settle claims from title defects that year. In other words, for every dollar that the industry took in as revenue, they paid out little more than a penny to policyholders."

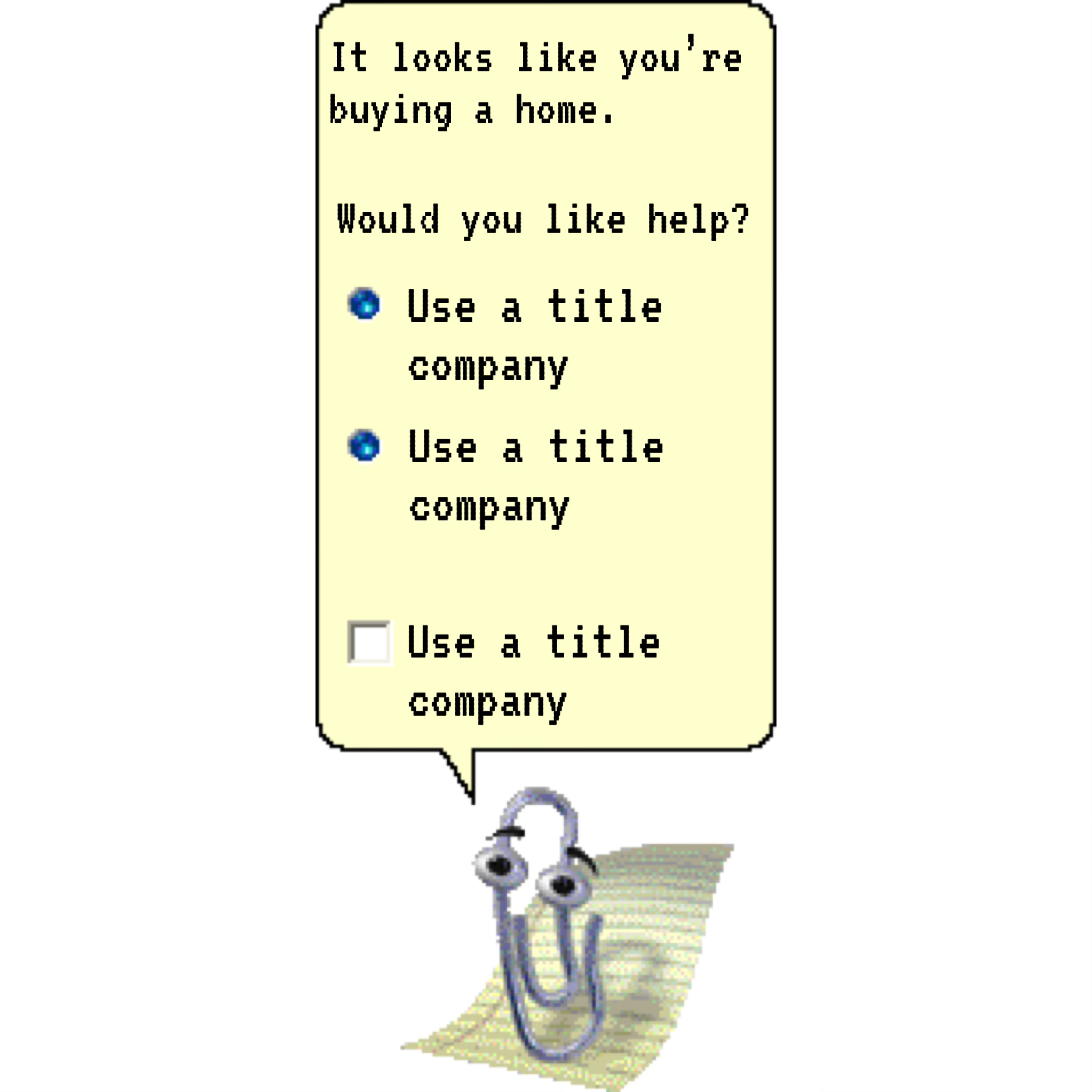

For anyone wishing to "unwind" or "skip" some of these processes during a transaction, severe difficulty is all but guaranteed.

Banks and mortgage lenders in the U.S. enjoy certain financial backstops and guarantees where home loans are concerned, via government institutions. But those benefits are only available if the lender can guarantee their position. Since the overwhelming majority of home buyers utilize a traditional mortgage loan when making a purchase, they are beholden to their lenders requirements for "doing the deal". Unless lenders suffer some negative consequence (or have financial incentive) to NOT use a combo title/escrow company to handle the transfer of their funds, anyone dreaming of a different system of escrow for real estate transfers is doing just that: dreaming.

There are any number of scenarios that could play out to forever alter the current modus operandi, but most of those scenarios are bleak and involve serious consequences. I'll explore some of those, along with some potential exciting alternatives that may come about in the future in part three of this series.